travel nurse tax home reddit

Travel to and from your tax home counts towards time worked. Travel Nurses actually have to prove that they are duplicating expenses.

Sisters Document Dayslong Journey From Ukraine To Portugal On Reddit

Instead of looking at the primary place of incomebusiness it allows the tax home to default fall back on the permanent residence.

. Get to see many areas of the country. It provides a lot of question in regards to traveling and taxes. Cali travel nurse looking for advice.

As a travel nurse in order to claim your tax free stipend you need to claim and pay rentmortgage for two residences. FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS. Essentially they are paying for their tax home and paying for housing at their new temporary residence.

So basically I. Basically a tax home is your primary residence where you live andor work. Text them and get told to join their FB group.

Tax homes tax-free stipends hourly wages bonuses benefits housing and per diem reimbursement are all factors to consider when understanding your travel nursing pay and taxes. 2000 a month for lodging non-taxable. Whats the fucking point in having.

If maintaining your tax home is too much work and you prefer to go from assignment to assignment without returning home do it. Just heard from my recruiter yesterday that my hours are being cut from 48 down to 36 per week and my rate is being cut by over half. For an obscure example.

While higher earning potential in addition to tax advantages are a no. You work as a travel nurse in the area of your permanent residence and live there while youre working. Cons of local travel nursing.

250 per week for meals and incidentals non-taxable. From tax homes to keeping your receipts to knowing exactly how your income will affect your long-term financial goals here is the information you need to know about travel nurse taxes. Builds a lot of new skills constantly.

There are always technicalities on top of sound bites. Youre basically working a job but with a longer commute and temporarily living in two locations. 2021 has been a unique year for travel nurses and some.

IRS doesnt really care about small time travel nurses compared to all the bigger fish in the sea they gotta deal with. Cant post asking to be directed to anything recent and have been told their FB group is the way to find a recruiterjob. Yes you may lose 4000 to 6000 in tax savings a year but the cost and time of maintaining your tax home may exceed that amount.

I could take a travel assignment in my same hometown and still receive benefits but where a lot of travel nurses will end up keeping money is on stipends and stipends not being taxed. Your blended rate is calculated by breaking down your non-taxable stipends into an hourly. Navigating taxes can be a bit different for travel nurses compared to traditional staff nurses.

The most common circumstance is renting both places or owning a home and renting your second residence. Thus working four consecutive 3 month assignments is actually greater than a year. Ive heavily researched travel nursing including the difficult tax parts of the job to make sure I dont get audited and I get the best experience possible.

You can review this four part series 1 2 3 4 for detailed information on how to accomplish this. Theres often a reason these unitshospitals are short staffed. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike.

RNs can earn up to 2300 per week as a travel nurse. The IRS requires that travel nurses satisfy three requirements to maintain a tax home and save on tax deductible expenses. I apply to contract jobs on their travel jobs pagehear nothing for weeks.

Since travel nurses are working away from their tax home certain companies must legally provide stipends andor reimbursements for their work more on this below. Establishing a Tax Home. You still need to set up housing.

Its not enough to just travel away from your tax home. Some agencies pay higher taxable wages and proportionally lower non-taxable reimbursements. One being your tax home and the other being the residence youll be living in while you travel.

For this to apply however the travel nurse must meet 2 out of 3 of the following criteria. 500 for travel reimbursement non-taxable. Can only find OLD job listings.

A bit technical and unlikely that a first line auditor would catch it in my belief anyway. While working as a travel nurse adds an additional layer of tax challenges it can also be a great way to gain a tax advantage. Of course this leads to controversy.

They often have problems Taxes can be a mess depending on the states you work. When youre working as a travel therapist having a tax home allows you to take housing and per diem stipends provided by travel therapy companies without having to pay taxes on them due to the stipends being a reimbursement for costs incurred at the travel. You lose the ability to work with different patient populations.

Deciphering the travel nursing pay structure can be complicated. Understanding Travel Nursing Tax Rules. The guidelines pertaining to taxable wages in the travel nursing industry are opaque.

Dont live your life around a tax deduction. First travel nurses should consider the possibility of establishing and maintaining a tax-home so that they can qualify to receive the tax-free stipends. Drastically narrows your opportunity of getting a travel contract.

Here is an example of a typical pay package. I assume that those who believe they dont have a tax-home are harboring this belief because. The 50 Mile Rule is one of the most common fallacies pertaining to tax-free reimbursements for travel nurses.

You dont get to travel and see the country. 20 per hour taxable base rate that is reported to the IRS. From what I am told from people who travel and still live with their parents is that as long as you pay them rent at market value that can be tracked down AND your parents puts that rent money as income for tax return it is full proof.

They assert that lower taxable wages will result in. Take a look at this link. Posted this on a different page but figured I would try to reach the most people so posting it here too I am in week 413 of my contract in California.

Okay guys I know this has been done before but Ive noticed a lot of misinformation being given by new recruiters and others. Licensing can be a mess depending on the states you work. Its prominent among both travel nurses and travel nursing recruitersPurveyors of this rule claim that it allows travel nurses to accept tax-free reimbursements as long as the travel assignment is 50 miles or more from the travel nurses tax home.

Im a Travel Nurse AMA. You maintain living expenses at your place of permanent residence. SnapNurse is literally the worst.

For true travelers as defined above the tax rules allow an exception to the tax home definition.

Anon Goes On Reddit R Greentext

Fake But Verified Mcdonald S Singapore Twitter Account Taken Down After Sparking War With Wendy S

Reddit Mental Health Labmt Txt At Master Gkotsis Reddit Mental Health Github

Shedevilbynight A Drama Disaster Megathread R Rupaulsdragrace

Funny Wall Street Bets Sticker Wsb To The Moon Reddit Wsb Etsy Marketing Quotes Funny Funny Stock Market Quotes

Messy Bun Tutorial Video In 2020 Hair Styles Long Hair Styles Hair Tutorial

30 Folks In This Online Group Share How Their Neighbors From Hell Earned Their Name Bored Panda

Reddit Thread Sheds Light On The Ways Parents Shame Each Other About Child Care And It Needs To Stop Parents

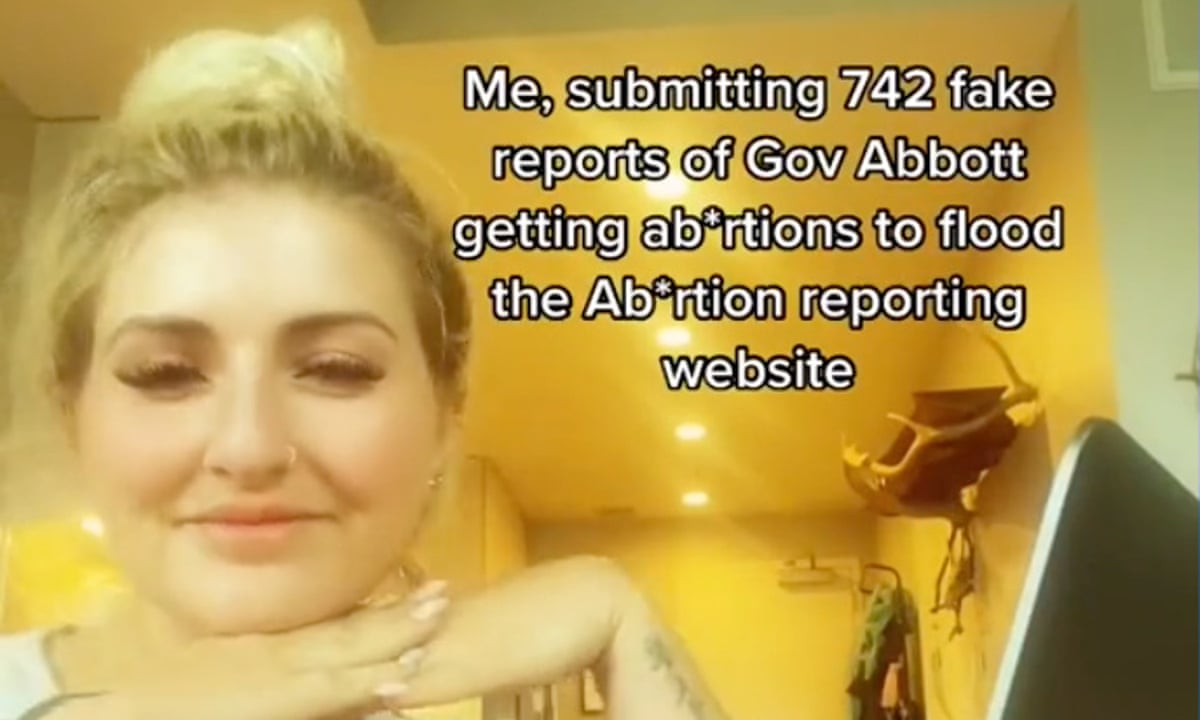

Tiktokers Flood Texas Abortion Whistleblower Site With Shrek Memes Fake Reports And Porn Texas The Guardian

Reddit Users Reveal What They Won T Do Ever Again In A Post Pandemic World

Reddit S Anti Work Subreddit Temporarily Shuts Down After An Awkward Interview Between A Moderator And Fox News Host Jesse Watters

Reddit Is Being Used To Diagnose Stds Why This Is Bad

2016 New Funny Pet Cat Pirate Costume Suit Dog Cat Clothes Pet Costumes Cat Clothes Pet Clothes

Tweets About Unpopularsuperheroes Hashtag On Twitter Accounting Humor Reddit Tattoo Man

Ultimate 2017 Marketing Planning Calendar Vandenberg Web Creative Marketing Planning Calendar Marketing Plan Planning Calendar

Reddit L2 Vocab No Entities Pos 100 Dat At Master Ellarabi Reddit L2 Github

I Can T Be The Only One Who Finds This Spam Annoying R Terraria